|

|||

|

|

|

||

|---|---|---|

|

||

|

||

|

||

|

||

|

||

|

||

|

|

|

|

First Time Home Buyer: A Comprehensive Guide to Getting StartedBuying your first home is a significant milestone and can be both exciting and daunting. Understanding the process and what to expect can ease your journey into homeownership. Understanding the BasicsBefore you dive into the real estate market, it's essential to understand the basics of home buying. This includes knowing your budget, the types of mortgages available, and the current standard mortgage rates today. Setting Your BudgetDetermining how much you can afford is the first step. Consider your current financial situation, including your income, debts, and savings. A good rule of thumb is to spend no more than 30% of your income on housing costs. Types of Mortgages

Understanding these options will help you decide which mortgage suits your needs best. Finding the Right HomeOnce you have your finances in order, it's time to find the perfect home. Consider the location, size, and type of home that fits your lifestyle. Location ConsiderationsThe location of your home can significantly affect its value and your quality of life. Research neighborhoods, school districts, and proximity to work and amenities. Home Features

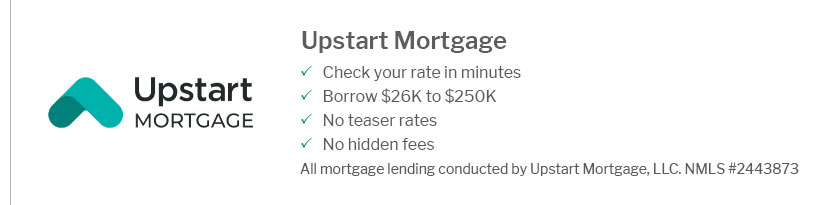

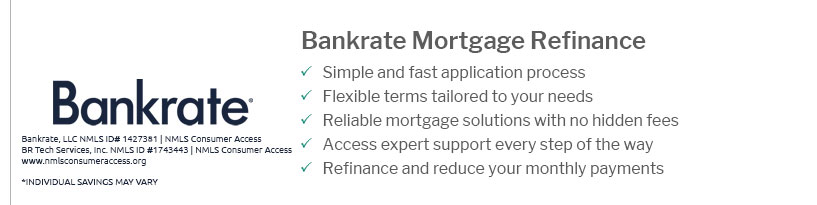

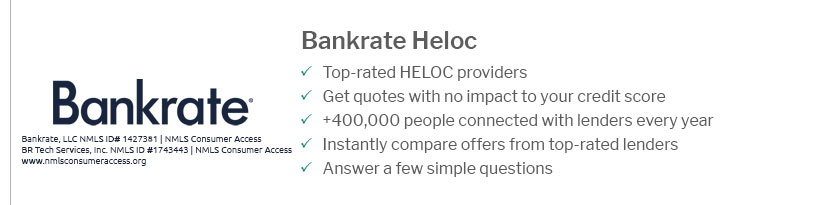

Decide which features are must-haves and which ones you can compromise on. Navigating the Buying ProcessOnce you've found a home, the buying process involves making an offer, securing financing, and closing the deal. Making an OfferWork with a real estate agent to make a competitive offer. Be prepared to negotiate on price and terms. Securing FinancingShop around for the best mortgage finance rates and get pre-approved to streamline the buying process. FAQWhat is the first step in buying a home?The first step is to determine your budget and get pre-approved for a mortgage. This will help you understand what you can afford and give you an advantage in the competitive market. How much should I save for a down payment?It's recommended to save at least 20% of the home's purchase price to avoid paying private mortgage insurance (PMI). However, some lenders offer loans with as little as 3% down. What additional costs should I be aware of?In addition to the down payment, consider closing costs, which are typically 2-5% of the loan amount, and ongoing costs such as property taxes, insurance, and maintenance. https://www.fanniemae.com/education

When it comes to buying a home, it can be hard to know where to start. That's why we're here to help. Our ... https://www.cityofmobile.org/departments/neighborhood-development/neighborhood-development-programs/downpayment-assistance-program/

The City of Mobile's First Time Home Buyers' Program is a homeownership program designed to help income eligible households with down payment and closing costs ... https://www.ahfa.com/homebuyers/programs-available

First Step. AHFA is bringing back this lender and homebuyer favorite. - Step Up. The Step Up program is available to homebuyers who earn less than the program ...

|

|---|